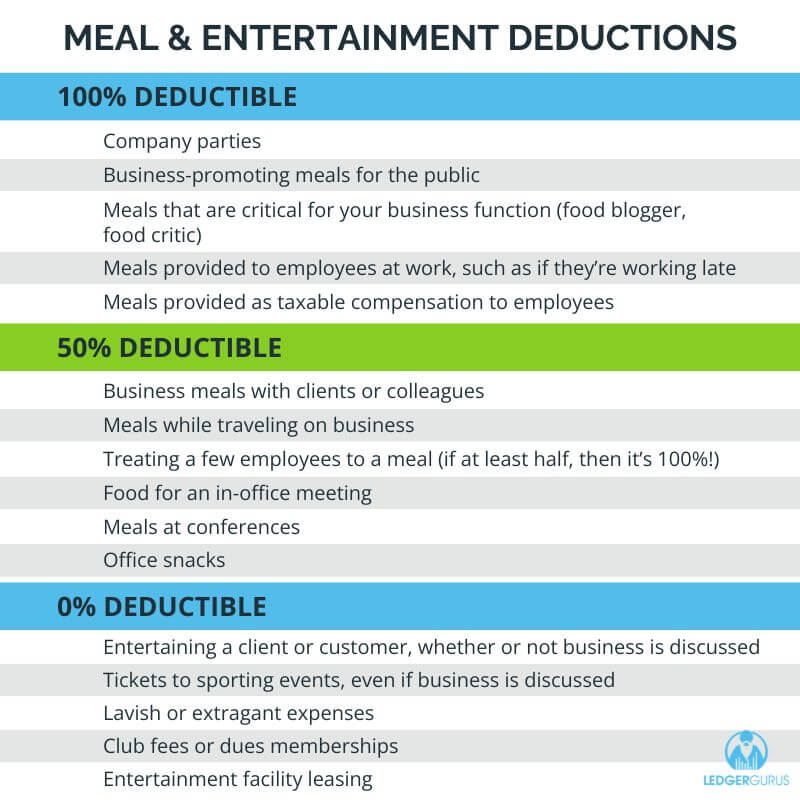

Meals With Clients Deductible 2025. When meals are provided for the convenience of the employer (e.g., working lunches), they are considered 50% deductible. Not quite) unfortunately, the party’s over for full deductions in 2025.

You might be wondering where you stand on your small business’ meals and entertainment tax deductions in 2025 and beyond—especially if you’re unfamiliar with tax.

100 Deduction for Business Meals in 2025 and 2025 Alloy Silverstein, Sadly, the value of the meal. Entertaining clients (concert tickets, golf games, etc.) 0% deductible:

How to Deduct Business Meals in 2025 Ultimate Guide, Prior to 2025, taxpayers could deduct 50% of their meal expenses incurred for business. Knowing the meals and entertainment expenses you can and cannot.

Are Business Meals Deductible In 2025 Year Torey Halimeda, One of the most noticeable alterations is the. Meals and entertainment deductions in 2025.

Deducting Client Meals (TASTY Expert Tax Advice) YouTube, However, when you’re uk contracting or at work during the week, at what point do you receive. Meals and entertainment deductions in 2025.

NEW Business Meals 100 DEDUCTIBLE Learn How to Qualify YouTube, According to the irs, you can write off your gym membership fees if they are considered an “ordinary” and “necessary” expense for your. Client and business meetings in.

Meals & Entertainment Deduction 2025 5 MustKnow Tips FlyFin, Prior to the enactment of the caa, the u.s. While some of the meal expenses can be deducted in full, some give a 50 percent of the expense in deductions.

How to Deduct Business Meals, Meals & entertainment (included in compensation) 100% deductible Knowing what meals and entertainment deductions you can take for.

Business Meals Now 100 Deductible The Royce CPA Firm, Let's say you take your favorite client to a beautiful lunch (to discuss business); Washington — the internal revenue service issued final.

Are Business Meals Still Deductible? IRS Issues New Guidance, The 2025 tax reforms have brought about significant changes to business meal deductions that directly impact our clients’ financial strategies. Client and business meetings in.

TaxDeductible Business Meals 2025 Limited Company Advice, Some business meals move back to 50% deductible. According to the irs, you can write off your gym membership fees if they are considered an “ordinary” and “necessary” expense for your.